How to Radically Simplify Your 2025 Sales Playbook with 2 Questions

TL;DR

One CRO we work with made a pretty radical decision this year.

He wasn’t the only one, but I think Charlie’s a good example, because when you hear his team’s high-level stats:

- $600M ARR

- GTM team of 250+ people

- Focused on enterprises with 10,000+ employees

The first word that likely comes to your mind is complex.

But the one word that now describes them is simplicity. Because after we re-wrote their sales playbook, it’s built on:

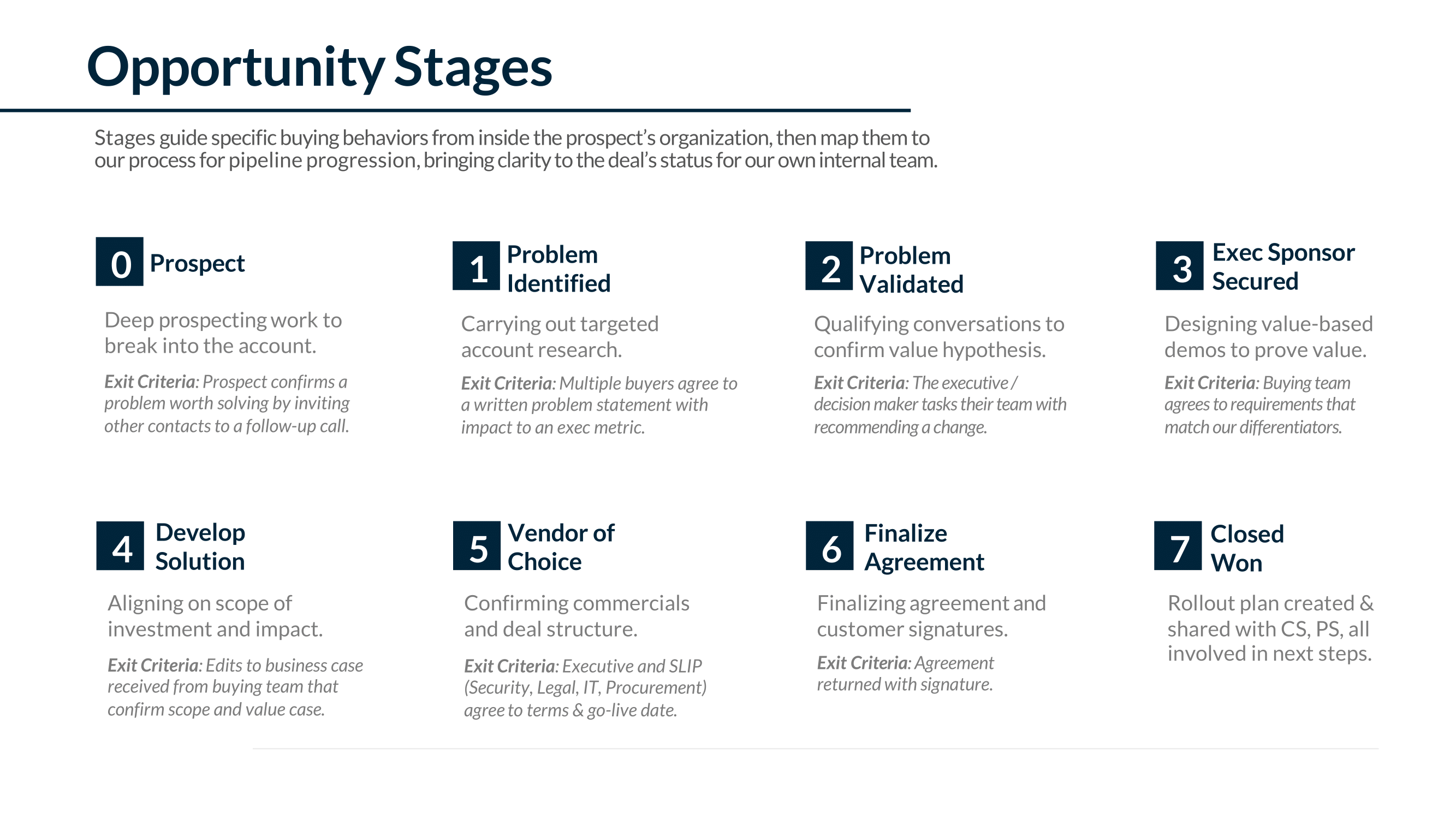

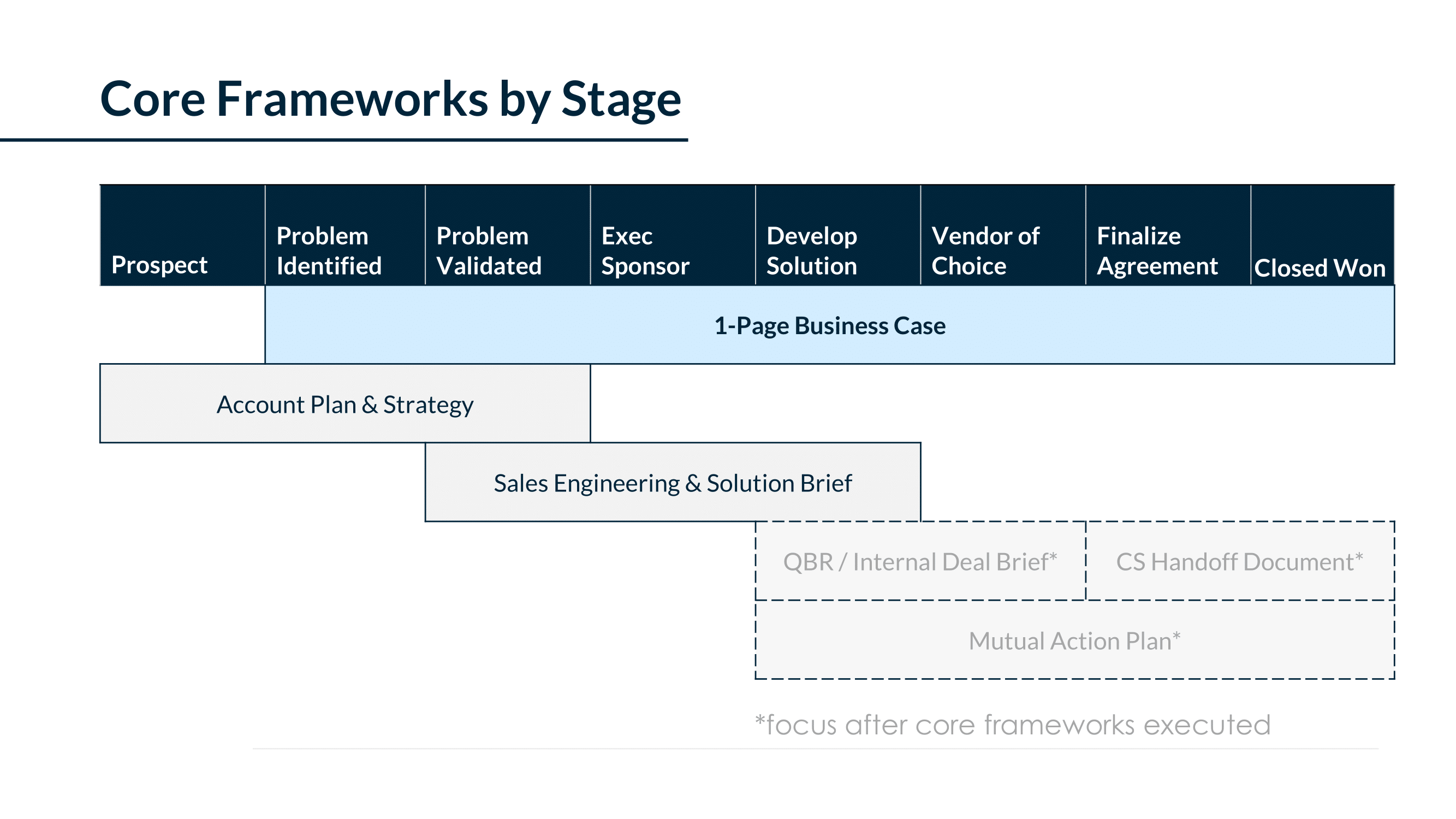

- 3 core frameworks, 1 - 2 pages long each

- 1-sentence exit criteria for each stage

- 1 required scorecard

That’s it.

Moving from complexity to simplicity, to give their team focus and that “ahhhh, finally” feeling.

Which all started with two questions I gave Charlie and his team. I’ll ask you the same questions here:

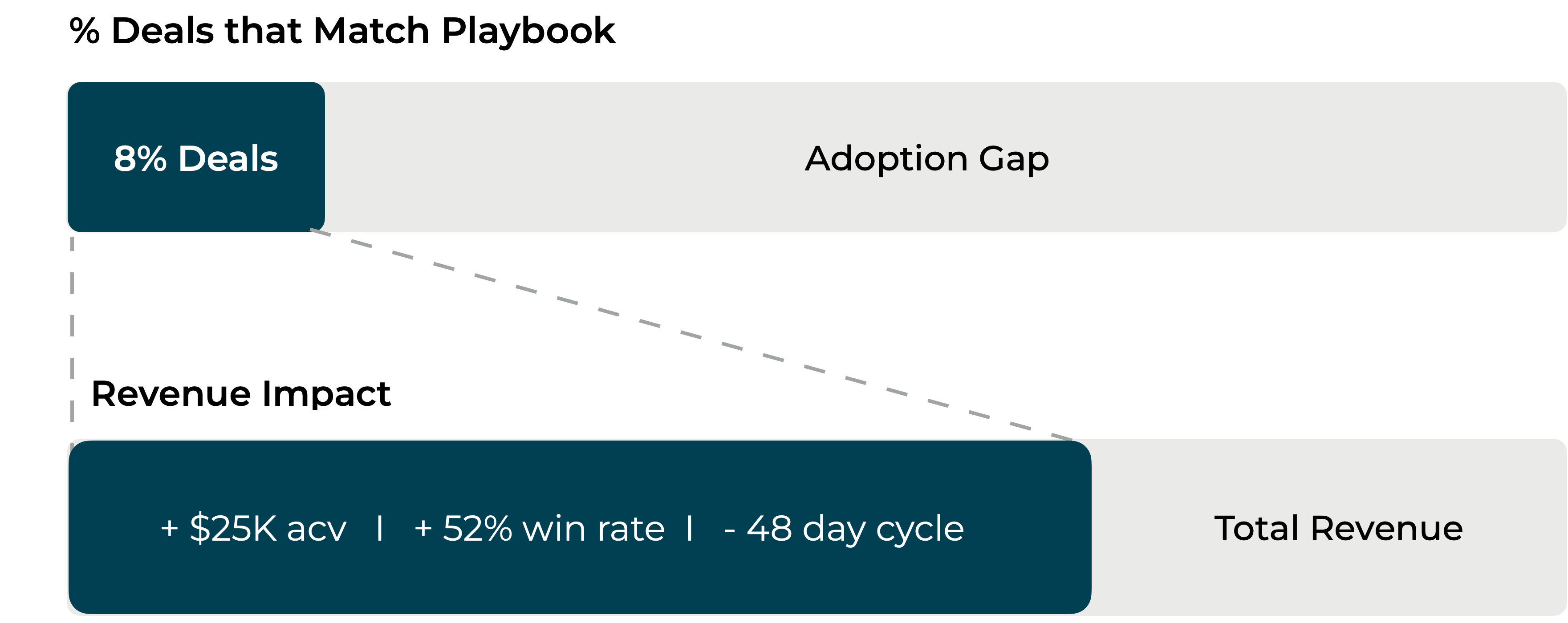

- What % of deals in our pipeline match our playbook?

- When deals do match our playbook, does sales velocity go up?

Why these questions matter for you.

First, notice we’re focused on the mid-funnel. Pipeline progression, not creation. Here’s why:

- Pipeline creation is harder, and more expensive. (ROI on pipeline creation dropped ~50% from 1Q23 to 3Q24.)

- Which means the faster, less expensive path to 2025’s plan is the mid-funnel: fixing ~20% win rates, while driving up ACV.

- Which ultimately shows up as increasing revenue/rep — every leader’s 2025 mandate. More revenue, with less people and pipeline.

Another point of context: we’re covering the two basic dimensions to enabling a sales team.

- Adoption: “are we doing it?”

- Impact: “does it work when we do it?”

So here those questions are again:

- What % of deals in our pipeline match our playbook?

- When deals do match our playbook, does sales velocity go up?

There are 4 ways to answer this, plotted on a 2x2 grid:

Which zone are you in right now?

- Objective: high impact and high adoption.

- Opportunity: more adoption means more revenue.

- Optimize: refocus playbook on higher impact activity.

- Obstacle: nobody’s adopting, because it’s not helping them.

Question 1, Adoption: What % of deals match our playbook?

To answer this, you need a practical way to test for it.

One that doesn’t mean more deal review meetings on the calendar. Which is why we’ve got a saying:

The deal’s not real if it’s not in writing.

You should be able to pull up a written record of where any deal’s at, and get the headlines in < 60 seconds.

So first, try this:

- Pick 5 - 10 deals inside your Q4 pipeline.

- Open up Salesforce/HubSpot and spot-check them.

- To what extent do they match your playbook? What evidence do you see they’re being executed “well?”

Writing forces clarity on deal & discovery gaps, and this is often its own operational shift:

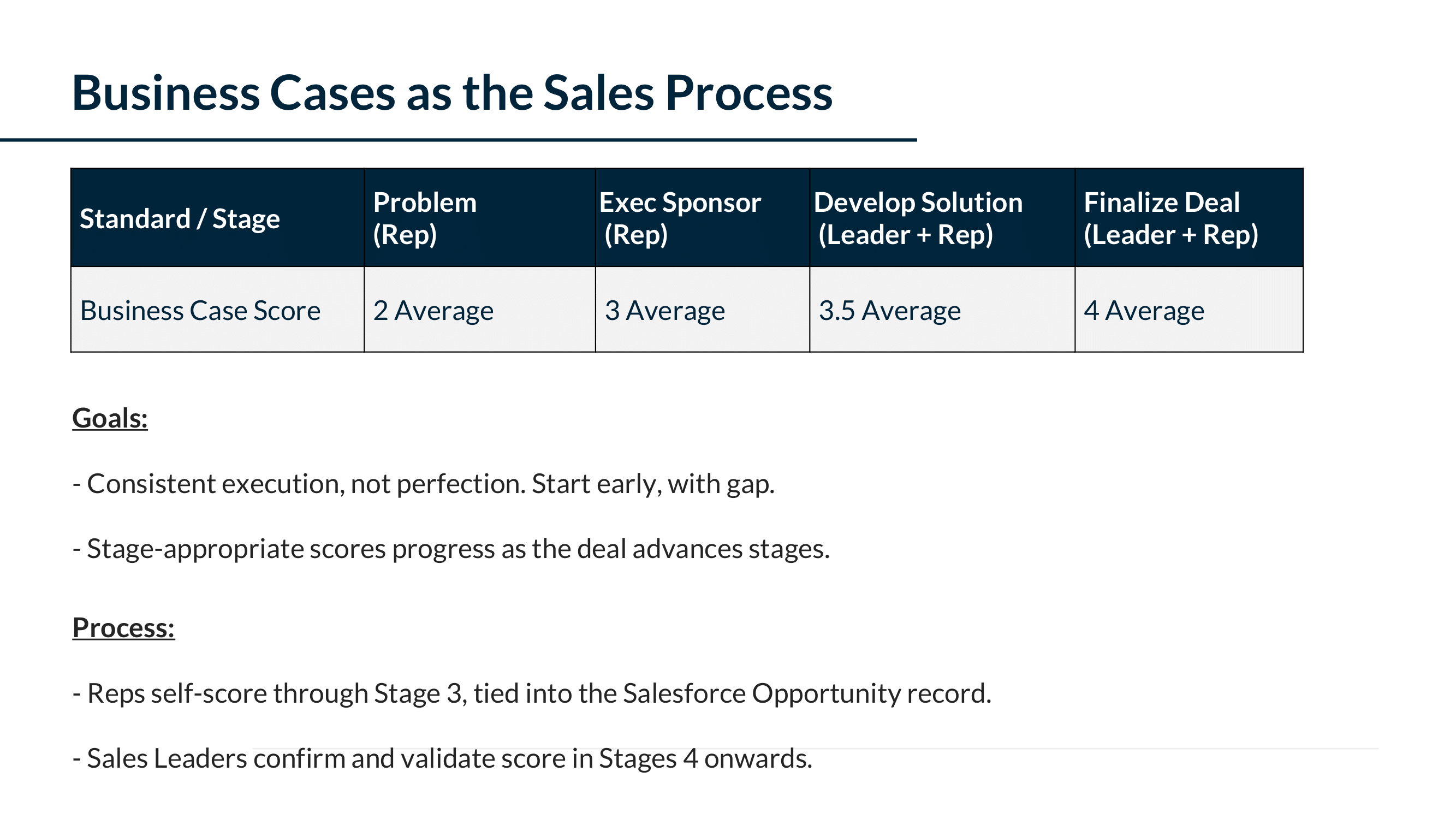

→ Thinking about a playbook in terms of “artifacts,” or written frameworks mapped to each stage:

This approach has 2 major advantages.

- For your buyers: short, written summaries can be “in the room,” even when you can’t be. Scripting the message for executive buyers.

- For your team: it’s how you’ll get everyone from your leaders to SE’s to CSM’s on the same page with the customer. Literally.

After your spot-check (which can/should be a regular report):

If you see a low % of deals matching your playbook, it’s probably suffering from complexity, and lack of focus.

Like the quote my friend Paul Stansik recently shared:

“The man who chases two rabbits catches neither.”

So here’s the next exercise. It’s as literal as it is metaphorical. The idea is to do less better:

1/ Throw out every activity in your playbook.

You should now be looking at a blank page.

2/ Add back just 1 core framework to start.

Which framework impacts revenue the most? (See question #2 below.)

3/ After 80% of deals have that framework executed, you’ve earned the right to “add” something else.

What’s the next most important framework?

Question 2, Impact: Does it make a difference?

There should be a WIDE gap in sales velocity (win rate %, cycle time, contract value $) between deals that do vs. don’t match your playbook in your spot-check.

If you see:

- A big velocity jump: spotlight the differences and drive more adoption. This is the “opportunity” zone.

- No big change in velocity: there’s a gap in the playbook. You’re in the “optimize” zone. See below.

If you’re in this 2nd group, the biggest playbook gap that most sales teams just don’t design for is this reality:

- 90% of selling (and all buying decisions) happen without reps in the room. So it’s the internal sale that champions lead that matters most.

- Yet, most sales playbooks only focus on sales reps in sales meetings. Not buyers in internal meetings.

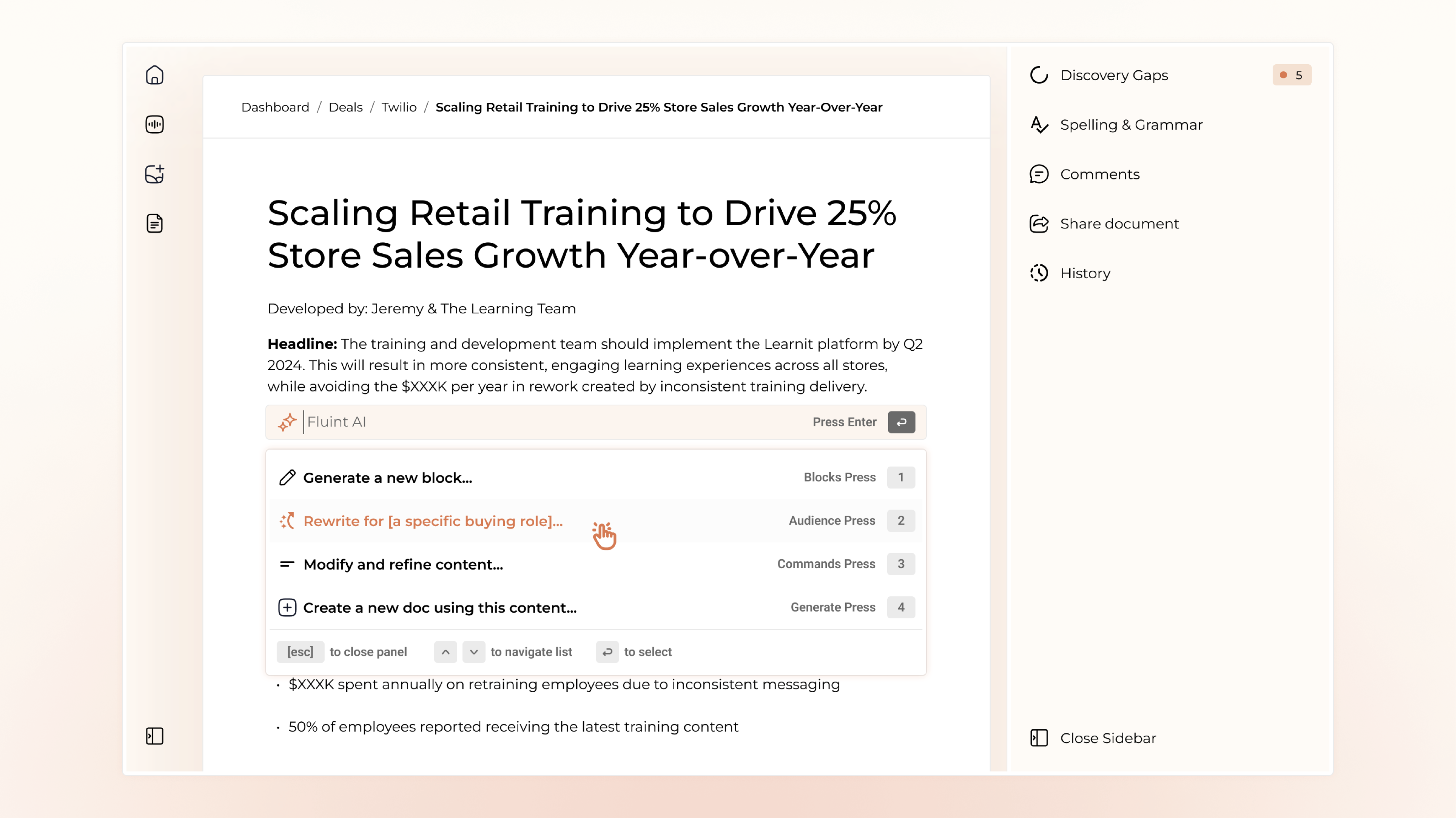

- That's why building a written business case with champions to guide them is usually “framework #1.”

If built with the buying team — starting early-stage and developing with the deal — this 1 page framework will mean millions in revenue.

If you need a framework to get you started, check this out.

FAQ's on:

Why stop now?

You’re on a roll. Keep reading related write-up’s:

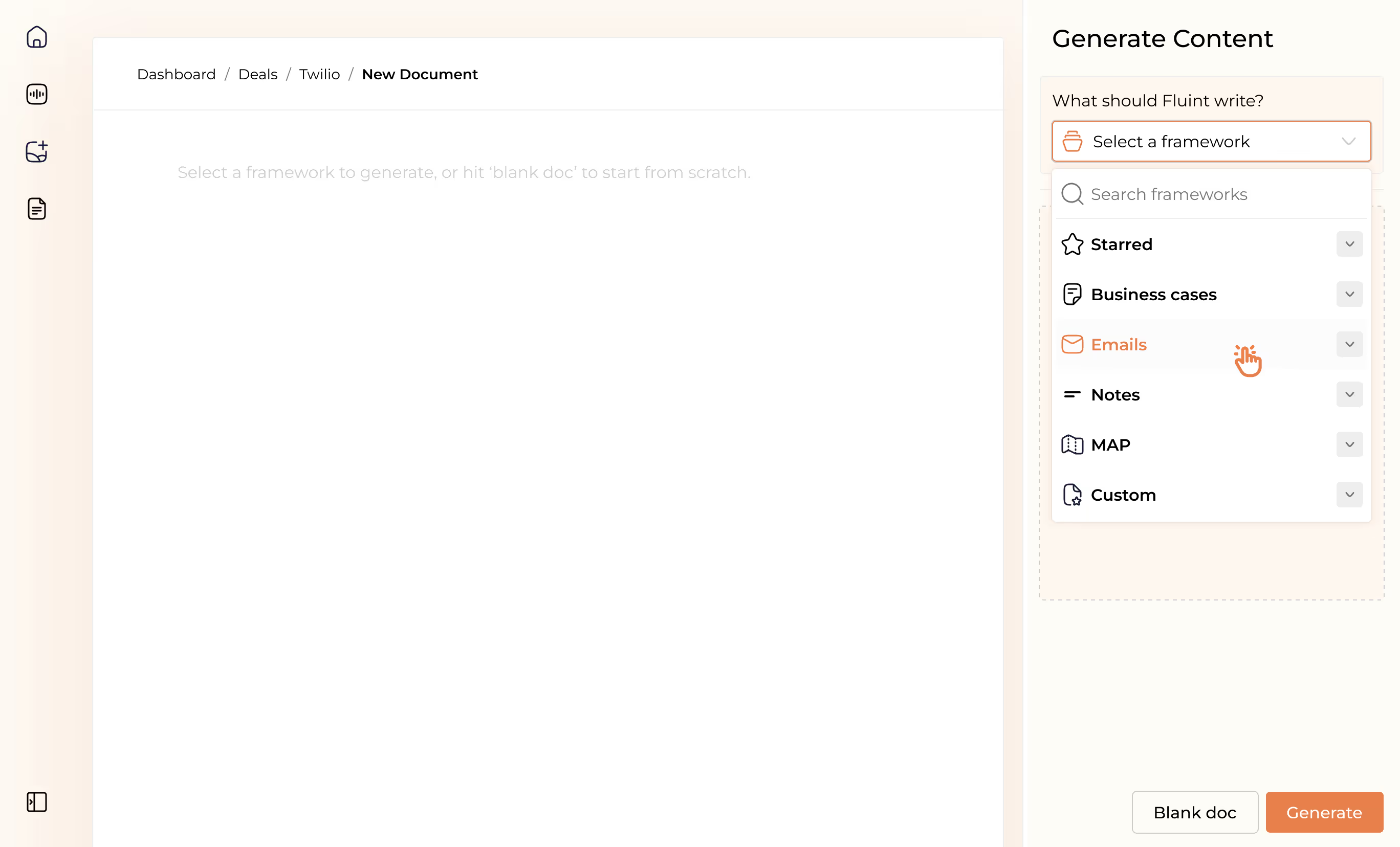

Draft with one click, go from DIY, to done-with-you AI

Get an executive-ready business case in seconds, built with your buyer's words and our AI.

Meet the sellers simplifying complex deals

Loved by top performers from 500+ companies with over $250M in closed-won revenue, across 19,900 deals managed with Fluint

Now getting more call transcripts into the tool so I can do more of that 1-click goodness.

The buying team literally skipped entire steps in the decision process after seeing our champion lay out the value for them.

Which is what Fluint lets me do: enable my champions, by making it easy for them to sell what matters to them and impacts their role.