Introducing Sales Process 2.0: Rewriting the Sales-Led GTM Playbook

Designing Your Midmarket & Enterprise Sales Process to Drive Both Velocity & Efficiency

Subscribe. Get new playbooks like this one by email.

Creating Context: A Thought Experiment

Let’s start things off with a simple thought experiment.

Picture this:

You’re sitting inside a leadership team meeting. The year just wrapped, and everyone’s reviewing the last 12 months of GTM performance data.

Your CMO’s first up, presenting past activity from pipeline and demand generation.

Last year, they invested in two main paid channels:

- Search (e.g. PPC ads)

- Social (e.g. LinkedIn ads)

The two metrics you’re reviewing for each channel are:

- Spend (% of total budget invested by channel)

- ROAS (return on that spend, $X in new pipeline generated for every $1 of spend)

What are these results telling you to do?

If you were your CMO, how would you adjust your plan for the next year?

Keep that answer in mind, and now let’s suppose your CMO says:

“We focused our investments on search last year. It’s always worked in the past, and social is new to us, but the results were a little disappointing. We didn’t lose money... but we didn’t break a 1:1 return either.

So next year, here's our plan. We’re going even deeper in refining our search process, to make sure that 90% spend we’re investing there again is more productive. Better copy, new ad creative...”

You’d be listening to those comments, staring at that slide, thinking, “Wait, what?! Why don’t we shift focus and invest more in social?”

Because that would be the fastest path to GTM efficiency:

- You’d produce 6X more while keeping spend flat, just by shifting focus.

- You could even reduce the total paid budget, and still generate more pipeline.

Now, here’s the point:

This exact same dynamic is playing out inside your sales organization.

Every single week.

Deals in your pipeline are managed with two different approaches:

- A: The typical sales process. Mediocre win rates, smaller ACV.

- B: A shift in process. A new approach that produces higher win rates, and bigger ACV. But it’s only being applied to a fraction of deals.

If your CMO saw you presenting a slide like this, what would they say?

(Maybe even scream?)

And what if, instead of making a serious shift in focus toward “Process B,” you said, “We’re going to double down and invest in tweaking Process A…?”

They’d look at you like you’re crazy.

(Are you crazy?)

You’re probably wondering, “So what’s the difference between Process A and B?”

Here’s the difference, based on our work with 332 sales teams:

- Process A:

92% of deals have no business case documented. Instead, the focus is on how sales reps sell during sales meetings.

- Process B:

8% of deals have a documented business case, built with the customer. To focus on how buyers (more specifically, champions) sell during internal meetings.

Make a quick note of this, and we’ll to come back to it:

We’re describing the business case as a process here.

Not a document. Not an activity. And not one part of another process.

The business case is the sales process.

That’s important.

But first, let’s look at the link we found between an updated sales process, and the two high-level objectives every sales leader is tasked with.

The Sales Leader’s Dual Mandate

Sales velocity. It’s the universal question across sales orgs:

Are we closing more deals, faster, at a higher ACV?

Sales leaders also have a second mandate, however. Beyond just increasing velocity, the real question is:

Can you drive more revenue, with less people and pipeline?

We’re long past the ZIRP days (zero percent interest rates). Which means there’s a premium placed on GTM efficiency. Setting up a dual mandate for every sales leader:

Velocity and efficiency, together.

Sometimes, it’s easier to tackle a goal by flipping it upside down. To first ask, “Well, what’s an inefficient sales process look like?”

The answer:

One that wins by force, not finesse. By constantly adding more people and pipeline (two big cost drivers), to win by volume not rate.

If you model out your sales process, you’ll find it’s all just a series of rate/volume equations like this:

- Volume: how many reps do you have selling?

- Rate: how much does each rep sell?

That’s the simplest version, and it gives you total Sales Capacity:

(Ramped-Rep Equivalents, or RRE for short, is my preferred way to measure headcount.)

Now, this is important: as Revenue per Ramped Rep (RRR) increases, you’re less reliant on headcount and significantly more efficient.

Why’s that? Because:

(1) Driving up RRR retains talent and creates upside.

- As the % of reps attaining quota increases, attrition decreases (generally).

- If a role does open up, it becomes easier to fill that role with talent.

- A higher % of tenured vs. newly-ramped reps increases the % of the team who’s likely to exceed quota.

(2) A smaller number of highly-productive sellers minimizes cost.

Requiring more RRE’s to hit your annual plan means:

- More first line managers to manage them ($$).

- More benefits, payroll, and recruiting cost ($$).

- More spend on pipegen to support them ($$).

- More enablement & revops complexity ($$).

So, while you could constantly add more opportunities to the pipeline, to boost the numerator in the sales velocity equation — and then hire a larger number of lower-attaining reps to manage all those opportunities — that’s not an option if efficiency is also a requirement.

The next question we come to, then, is how do we maximize RRR?

The Drivers Behind Rep Productivity You Can Control

Before we dig into that, let’s level-set on this:

Productivity isn’t about increasing the number of sales activities completed. It’s about decreasing the activities required to generate a new $ of revenue.

In other words, if you want to generate another $50K and:

- Rep A needs 40 activities and 10 hours (meetings, calls, emails, etc).

- Rep B needs 20 activities over 5 hours.

Then Rep B is twice as productive as Rep A.

Every hour of Rep B’s time produces $10K for the business, vs. $5K per hour by Rep A.

When all reps look like Rep B, RRR goes up. Sales Capacity increases, and you’re delivering more revenue for less cost.

If we expand on the Sales Capacity model above, we find RRR is driven up by all 4 factors inside the Sales Velocity equation:

- Increasing # qualified opportunities (without shortchanging other drivers).

- Closing a higher % those opportunities.

- Increasing the $ value of each deal closed.

- Closing them faster, effectively extending the selling year.

You could even take that a step further if you’d like. Because all of these drivers have their own set of drivers.

For example, we can drive up ACV by:

- Increasing pricing.

- Avoiding discounts.

- Bundling in new products.

- Adding professional services.

Some of these drivers won't be within your direct control. (For example, what if you’re not a multi-product company and can’t created a bundled contract?)

But what is always directly within your control is how you sell.

Which is defined and guided by your sales process.

Designing A High-Velocity Sales Process

So far, we’ve said that:

- GTM efficiency depends on driving up RRR. (Not just adding more people and pipeline.)

- Increasing RRR depends on driving up sales velocity.

- Sales velocity depends on your sales process.

Now, let's go back to a point we made earlier:

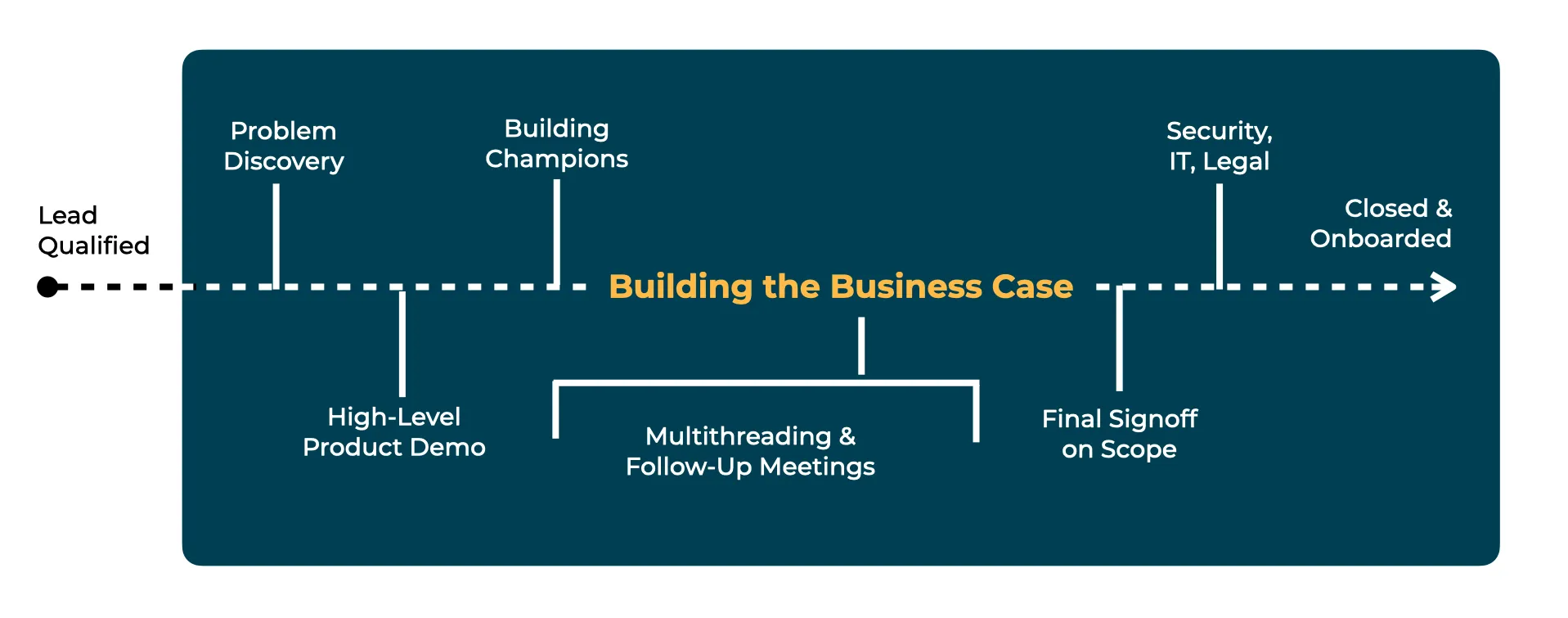

The business case is the sales process.

Contrast that with the classic sales process, circa 2002, which we'll call "Sales Process 1.0.”

Which still captures how 90% of sales teams go to market today. And it goes a little something like this:

To be fair, you could dress up those stages. Sprinkle in some champion building, some multithreading.

But even so, inside Sales Process 1.0:

- Business cases are a point-in-time part of the process.

- If they’re built at all. Only 8% of deals have one, from our study across 332 companies.

.webp)

The right way to think about it — to build out "Sales Process 2.0" inside your team — is this:

- The business case is the process.

- All GTM activities and roles are guided by it.

- It starts in “Stage 1,” and builds through expansion deals over the full customer lifecycle.

The further you read, the more we’ll talk tactics on exactly how to make this shift, and what a “good” business case (aka sales process) includes.

But first, let’s link this idea to sales velocity, by looking at the impact to each velocity metric by comparing:

- The 8% of deals where the business case is the process. Sales Process 2.0.

- The 92% of deals run in the traditional process, without a business case.

A deeper sampling from this study included 20 companies, where a comparison of 50 deals included:

- A business case that was created between July, 2023 and January, 2024.

- Contract values ranging from $35K to $350K, to focus on mid-market and enterprise.

- Recurring, B2B software as the main focus. Services accounted for 12% of contract values.

- A fraction of deals, 17%, included a trial or POC, which was treated as a part of the overall sales cycle time.

To create a "control group," we took the average sales velocity from all other deals in the companies' pipelines. Of course, given the 8% vs. 92% skew, there were a lot more deals created without a business case during this period.

And while a higher volume of deals will in fact drive up sales velocity, for the sake of comparison — since what we’re outlining here won’t help you generate a higher volume of opportunities — we held this number steady in the table below.

Here are the findings:

At first look, the data’s a little shocking. I was surprised the gap is this wide. But it’s a gap that’s well documented:

Ebsta & Pavilion’s 2024 State of Sales report — which draws on a larger dataset — found an 8.9X difference in velocity between top performers and everyone else:

Inside that report, notice the discussion on how top performers focus on enabling buyers, to disarm internal objections. Top-performers like Mitchell, Gabe, and Cobi.

Why the Execution Gap Gets Wider, and Wider

If we know deals with a business case close at a higher rate and value than those without one, then why aren’t we building more business cases?

Why’s the execution gap so large?

And, why does the chasm between top performers and everyone else continue to increase?

A main reason is that a shift towards "Sales Process 2.0" represents a fundamental change in the way sales teams go to market:

- It feels safer to double down and tweak the old concept. Investing in a brand new concept seems far more uncertain, so we avoid it.

- When we stick to tweaking the old thing, things do get better. We see marginal gains. Just enough to keep hope alive while we think, “Let’s stay the course.”

But eventually, we realize we’ve hit a “local maxima.” We have to take a different path to breakthrough to the “global maxima.”

A conversation from inside the Mercedes Formula 1 team, shown in the Netflix documentary Drive to Survive, captures this idea really well.

Toto Wolff, the team’s CEO, is talking to Lewis Hamilton, their top driver. They’re unhappy with their car's performance, which just can’t keep up with the other teams.

So Toto says:

Did you catch that?

Sticking to the concept from last year, holding onto it because of the encouraging results at the end, that was the biggest failure. The time’s come to cut our losses and say, the concept is never going to work. We’ve got to change it for next year.

We’re driving revenue, not cars. No doubt. But still, it’s kind of a perfect metaphor, isn’t it?

Just replace “car concept” with “sales process.”

To continue the metaphor, we think our sales reps are in the driver’s seat. But they’re not — our champions drive deals forward. At their finest, sales reps are more like Race Engineers.

They see all their communications — conversations, async messages, written content, etc… — as just a fraction of what it takes to win a race, and they use their words to help their drivers (champions) navigate the track (buying process).

Helping to avoid loss from the car (deal) stalling out, or, a competitor taking the lead.

While you consider to what extent Toto’s comment does or doesn’t characterize your situation, let’s figure out how big the execution gap is inside your team today.

With just one question:

What % of deals in your pipeline today have a documented business case?

Pick a group of 10 or 20 deals in your pipeline.

How many of them have a business case in place?

Well, before you can answer that, we have to talk about what a business case is — and what it’s not.

What Exactly is a Business Case (Not)?

Use the phrase “business case” in a group setting and it’ll mean 5 different things to 5 different people. So here’s the definition we’ll work from:

Business Case (noun)

/ biz.nis keis /

The process of documenting an account-specific narrative, with the customer.

In addition to the business case being the process, which we covered above, notice each new word we’ll unpack:

- Documented

- Account-Specific

- Narrative

- With

Business Cases are Written Content ("Documented")

Most teams invest lots of time and budget in call coaching, running demos, and building decks for sales meetings.

All good things.

But do you know what your buyers are saying during their internal meetings about you, without you? When a decision’s being made, and you’re not in the room?

I’ll go out on a limb and guess the answer’s not quite to the extent you’d like. Which is why reps need to actually write down their business case:

Your content can be in the room, even when you can’t be.

Scripting your champion’s message, and influencing the meetings you’re not part of. Which, by the way, is most of the buying process (90%).

Content is how you overlap with the internal activities happening behind closed doors:

“Account-Specific” Content, not Templates

It’s not just about sharing content, though. Tweaking the same template product deck doesn’t cut it.

Even with a personal “why us, why now” slide... that’s not a business case.

Business cases aren’t:

- Template decks

- Branded case studies

- Enablement material built for “personas”

- Generally: anything filled with marketing speak

It’s about developing “account-specific” content, to make your message look and read “internal.” More neutral, less biased.

Using the buying team’s internal language to drive the majority of the words on the page is how you’ll do this.

Fluint’s data shows that as the ratio of unique words on the page increases, so do win rates:

- 10% unique content: 1.3X close rate

- 40% unique content: 2X close rate

- 80% unique content: 6X close rate

If your content sounds like your champion wrote it themselves, it’ll get shared and read.

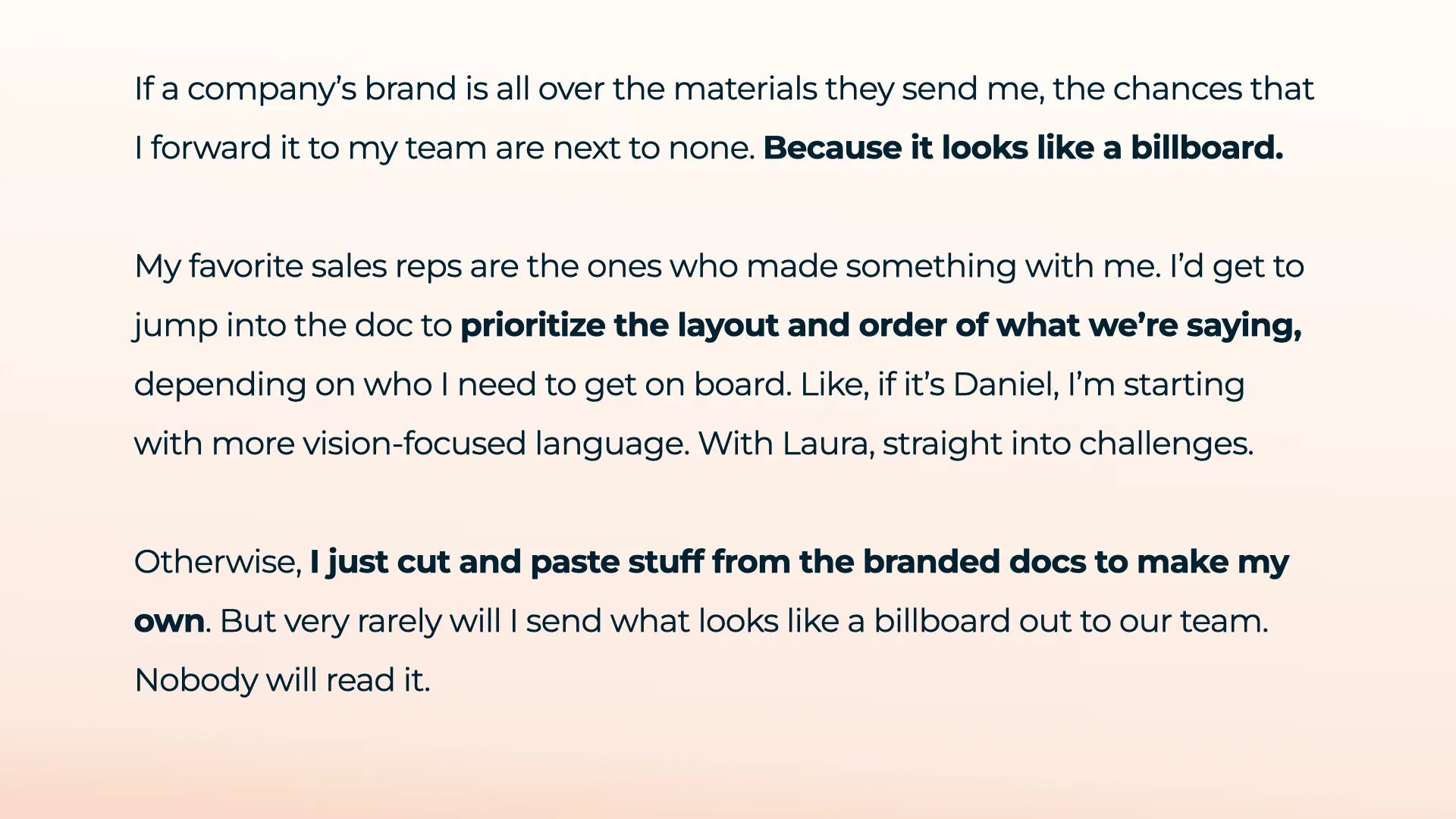

Related, check out this point from a Director of Product Development, who owns a $10M budget for a Fortune 100 cable company:

Narratives, Not Just Numbers

The term “business case” is a bit of a misnomer. It sounds too logical, like it’s all about “the numbers.”

But business cases are an exercise in creative, original thinking. Not plugging numbers into an ROI calculator:

- Numbers without a narrative are meaningless.

- Narratives create context that brings meaning to the numbers.

Because narratives connect you to the stories and priorities executives are already sold on, and actively investing in.

They also help overcome every Value Engineer’s three big frustrations:

Selling With Buyers, Not to Them

Sellers are editors, not authors.

It has to be this way. Because if the customer’s not involved in creating the business case, they won’t own it or use it.

The question most people raise at this point is:

Well, how am I supposed to draft a business case if I don’t have a champion?

But the question misses the whole point:

The way you build champions is by building the business case.

When you start this early in the deal, you’ll have lots of discovery gaps.

Those gaps create the space to build and co-create with your buyers.

Turning your deal into a fill-in-the-blanks exercise kicks the IKEA Effect into gear. Moving you from the shallows, into the “3rd” level of a deal:

- Level 1 is features. "Here's what it is."

- Level 2 is benefits. "Here's what it does for you."

- Level 3 is ownership. "Here's what I made.”

This also turns a business case draft into a discovery roadmap, guiding your future conversations and highlighting areas to dig deeper:

The 1-Page Business Case Framework

At this point, hopefully, you’ll realize that what I’m about to share inside this section isn’t another “cool template.” Instead, it's the sum total of:

- Sales Process 2.0.

- Which impacts every role inside your revenue organization.

- And drives up both velocity and efficiency, at the same time.

It’s called the 1-Page Business Case because, well, it’s one page.

Here’s how it reads, followed by a line-by-line breakdown on how to craft each section.

1/ Priority-Driven Headline

Right upfront, signal you're aligned with a priority the C-Suite’s already sold on.

Then, create context while setting the stage for the problem:

- Identify the executive sponsor.

- Align to an existing business initiative or project.

- Reference a project codename or unique phrase.

- Make the deal time-bound, with a critical event date.

2/ Sharp Problem Statement

Use visual language to paint a picture of a big problem blocking that priority.

(If you’re going deep in discovery, you’ll have the inputs to outline this with ruthless specificity.)

- Detail a high-cost problem, using customer-validated metrics.

- Identify who's impacted with consensus from multiple people.

- Reframe workflow-level issues around business impact.

- Outline why the problem's growing worse over time.

3/ Recommended Approach

This is how you'll create a logical connection between their problem, and your product, while sharing the "beliefs" that walk buyers up to your solution.

- High-priority, required capabilities align with competitive differentiators.

- Signoff from everyone across end users through Security/IT/etc.

- Alternative approaches openly discussed and ruled out.

4/ Target Outcomes

This piece ties back into 1 & 2 above, and it show execs the payoff they can expect — based on their decision to follow the recommended approach.

- Specific outcome metrics identified.

- Customer-validated inputs measure the change from current → future state.

- Applicable scenarios and sensitivities labeled.

- Vivid language builds emotion beyond "ROI."

5/ Required Investment

Finally, setup the discussion on change management.

Your buyers are investing a whole lot more than just their budget.

Show you know this, and have a plan to ensure it goes smoothly:

- Budget and commercials signed off on.

- Dedicated people resources reserved for rollout plan.

- Go-live date anchored to a customer-provided 'critical event.'

- Backdated series of steps included to reach customer outcome.

Here's a full, 30-minute deep dive on the framework:

Now, here's where we've come to:

If a business case — as we just defined and outlined it above — was created for every single deal in your pipeline…

Would it make a difference?

Would it make a dent in your sales velocity?

You’re probably thinking something like:

Well duh, if we had a “perfect” business case like this, how could we not sell more? But that’s a far cry from what our reps are doing today.

That’s a fair point.

And it brings up our next question:

How “good” does the business case actually need to be?

Based on the scorecard from inside Fluint, a “C-” is your target: 72%.

That’s the “Mendoza line” where the gap in sales velocity opens up:

Which should be encouraging news.

Driving revenue impact with Sales Process 2.0 is more about the presence of a business case, while following the process. Not perfection.

Which bring us back to the RRE metric we started with: have you hired, at minimum, a group of C players?

If your sellers (with the right process, enablement, and tooling in place) can’t reach a C average, then you’ve got a hiring and talent problem. Not a process problem.

But otherwise, impact’s entirely within your reach.

How Sales Process 2.0 Impacts Your People

We’ve covered a large chunk on process, so now let’s talk more about people. Then we’ll swing back to process, talk sales stages and exit criteria, then finish up with tech stack.

Beyond the main outcome of driving up RRR, the rest of your revenue organization is going to notice a change for the better, too.

Sales Process 2.0 means:

- Sellers: new job descriptions focused on creating & enabling champions.

- Leadership: forecasts are grounded in evidence of buying behaviors.

- Sales Engineers: pre-demo briefs guide what to show, and how to frame it.

- Enablement: skills gaps exposed to create coaching and training plans.

- Value Engineers: narratives built early in a deal to bring meaning to ROI.

- SalesOps: minimum standards defined by stage for clean CRM data.

- Customer Success: go-live plans with specific customer expectations.

It's also the most practical, hands-on way to enable each skillset reps need:

- (Discovery) Are we finding a compelling reason to change? How much data vs. fluff is on the page? Did we get past products and process, to priorities and customer projects?

- (Demos) Do we know which outcomes matter to the team? What their required capabilities are? Which features we’ll spend more or less time on accordingly?

- (Internal Alignment) Does our own executive have enough context before joining a call? What should CS, services and implementation expect to deliver? When are we going live?

- (Multithreading) How many people do we have input from? Does this represent one or multiple points of view? Who contributed what content? And do we have “evidence” of their engagement?

- (Forecasting) Does SLIP (security, legal, IT, procurement) have the strategic context to push this deal through on time? While keeping deal value intact, as we negotiate commercials?

- (Champion Building) Did key contacts with internal influence help write this? Do they feel a sense of ownership? Did they change our draft to make sure it’ll land?

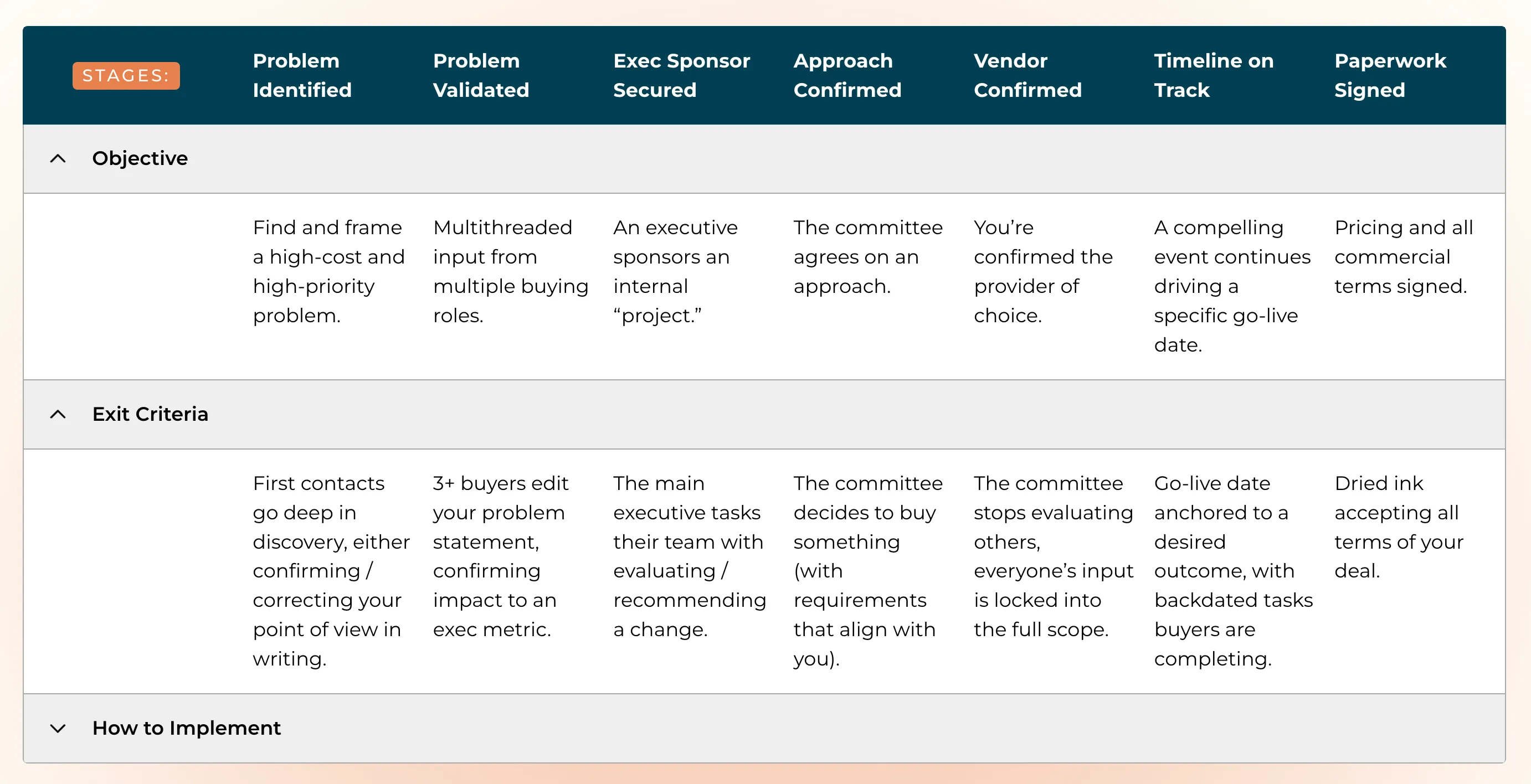

Mapping Sales Stages to Buying Behavior

Good sellers enable good buying behaviors.

So as part of rolling out your Sales Process 2.0, over time, you’ll discover you can (and should):

- Define and attach specific buying behaviors to each deal stage.

- Develop exit criteria you can test for based on those behaviors, so deal progression is directly tied to evidence captured inside the business case.

For example, it really doesn’t matter that a seller “sent a proposal.”

What actually matters is, does the executive care? Did they read it? Are they sponsoring a “project” it can impact?

Here’s a stage-by-stage breakdown you can take and adapt, focused on new sales first. (The same principles apply to expansion and upsell, too.)

.webp)

For a complete Sales Process 2.0 framework to guide your implementation, go here. It includes:

- Specific buying behaviors mapped to each stage

- Simplified exit criteria to guide deal progression

- 3 to 4 how-to frameworks + guides for every single stage

For most organizations, this will simplify a lot of overly complex criteria. By focusing on just one sentence per stage.

Another way to operationalize this is using a single field in the CRM with the business case “score.”

As a deal progresses through each stage, that field is updated, and should grow stronger.

Feel free to adjust the specifics, but it’ll look something like this:

- Stage 1 = 20%

- Stage 2 = 40%

- Stage 3 = 60%

- Stage 4 = 70%

- Stage 6 = 80%

- Stage 7 = 90%

Which implies a way to compare gaps in each deal against "what good looks like." So, just like you'd use a scorecard for a single call review, you can and should test the entire deal's strength with this scorecard.

.webp)

For a step-by-step walkthrough on the phrases, practices, and seller behaviors that drive deals through each of these stages, check this out:

Building Your Tech Stack to Shift to Sales Process 2.0

Consolidation is the main goal for most RevOps and SalesOps teams this year. It’s a good goal, too. Less sprawl, less to manage. Who wouldn’t want that?

But consolidation doesn’t actually fill gaps in a tech stack.

It just covers all your existing use cases, with less tooling and spend.

So revenue continues to leak through those execution gaps — especially when there’s a job-to-be done that’s frequent, high-value, where manual solutions produce a lower quality of work.

Check out this framework on horizontal vs. vertical tech, and the matrix here:

In the past, sales tech has largely focused on the sales rep, in the sales meeting.

Which means that even with lots of tools and spend in the stack already, the way a rep operationalizes Sales Process 2.0 looks something like this:

Which makes it hard to blame reps for business case coverage sitting at just 8% of deals.

Who’d follow a process that looks like that?

A fundamental shift in the way sales teams go to market calls for an updated tech stack to match.

Which is why we built Fluint: the only B2B sales platform purpose-built to bring Sales Process 2.0 to life.

As one example: Fluint converts your sales calls into an exec-ready business case buyers will actually read, in < 30 seconds.

(All mapped back into your CRM.)

While learning from closed-won data, and keeping your business case content updated as the deal evolves throughout the full customer lifecycle.

It make the process look more like this:

Driving up consistent execution across all deals. You can see one example of how it works, here:

See more FAQ’s on this topic, here.

A Parting Thought

One last thought for you comes from the author Shane Parrish:

Before you work harder on something, identify the point of leverage in the situation. Working harder on the wrong thing won't move you forward.

The idea is that business cases create leverage.

Which produces outsized results, not small and incremental gains.

I won’t try to suggest that what we’ve outlined here is the panacea, either. You won’t get 100% adoption, and you’ll face resistance to change.

(In some organizations and from some sellers more than others.

No doubt, you’ve got other projects you’re actively investing in already, too.

But you might be surprised just how many other “priorities” on that list are low-leverage fixes, that fall in priority once you introduce Sales Process 2.0:

If you’re a sales leader who found this write-up interesting, and would like to explore how Fluint can help, let’s talk.

Finally, if you found any part of this content helpful, we'd really appreciate you sharing.

This write-up took 18 months to create, and only a few seconds to share.

Oh hey! If you made it this far... you might want to test drive Fluint

Fluint lets you apply everything in this playbook to the deals you’re working on, right now. Get an executive-ready content in seconds, built with your buyers words and our AI.